Chances are you’ve heard the term “mining” tossed around bitcoin, but how can one mine a digital currency? It doesn’t involve shovels or digging for gold in the desert, yet there are similarities.

Mining bitcoin involves high-powered computers that solve complex computation-based math problems. Just like a miner digs through the dirt to strike gold, these computers are sending hashes, or attempts, to solve the math problem in return for bitcoin as a reward. When a miner successfully solves the problem, they create a block and get rewarded 12.5 bitcoin for their effort. A block is formed every 10 minutes and it is how transactions get sent through the network. While earning a bitcoin payout in exchange for computing power and electricity, this process is also the backbone of security for the entire network.

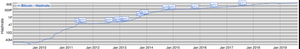

The bitcoin hash rate represents the power of the network. When bitcoin was invented, the hash rate was about 6 MH/s - there were 6 million attempts each second to solve the problem and receive the bitcoin reward. Ten years later, the hash rate is at an all-time high, flexing 75 EH/s, or 75,000,000,000,000,000,000 hashes per second (75 quintillion, 7.5 x 10^19). For some perspective, The International Union of Soil Sciences estimates there to be 7.5 quintillion (7.5 x 10^18) grains of sand on Earth. That’s right, there are more hashes fired every second in an attempt to earn a bitcoin reward than there are grains of sand on the entire planet.

Bitcoin Mining is often used to describe the health of the bitcoin network. The higher hash power of the network indicates stronger security to bitcoin’s only potential breach – a 51% attack. A 51% attack is where a group of miners come together and take over a majority of the hash power. With this force, they can then violate the blockchain by double-spending, basically creating money for themselves. As network power grows, it becomes increasingly more difficult to obtain 51% of hash power. Not to mention the economic incentive that has stopped this from happening before. Even if a group of fraudulent miners came together and spent millions of dollars to acquire this power, the second they started attacking the network, the network loses its value. By the time they could actually do any damage, the bitcoin price would drop and they wouldn’t make a fraction of what they spent.

Bitcoin mining is currently concentrated in China due to low electricity costs and friendly legislation compared to other parts of the world. According to a report published by Coinshares, 50 percent of the global bitcoin computing power is located in China’s Sichuan province. It’s even rumored that some Chinese power companies point their excess energy towards Bitcoin mining facilities so that no energy goes to waste.

To combat the potentially fatal centralization of bitcoin mining in China, Blockstream, led by Adam Black who was mentioned in the bitcoin whitepaper, just launched the Blockstream Mining colocation service. Their goal is to redistribute the power back to the people and forestall a possible 51%. Blockstream is a global leader in bitcoin and blockchain technology, and their mining venture is a force to be reckoned with:

We were one of the first Bitcoin mining companies to enter the Quebec hydropower market, long before the recent “gold rush” began, and together with our facility in Georgia, USA, we now have over 300MW of energy capacity secured (with more sites on the way). We also have a self-mining operation, which represents less than 1% of the global hash rate, running on a combination of hardware from Bitfury, Ebang, MicroBT, and other manufacturers. Since then we have scaled up our operations, secured additional sources of power, and expanded our service to provide hosting to clients that include the Fidelity Center for Applied Technology and LinkedIn co-founder Reid Hoffman.

Bitcoin mining has grown at an exponential pace along with bitcoin price over the past decade. Due to the massive powerhouses like Blockstream moving into the space, mining for individuals is mostly a thing of the past. Based on mere electricity costs in most countries, mining bitcoin will lose you money even with the newest hardware. Many speculate that the mining break-even price is often the floor for bitcoin price. It varies drastically based on electricity cost, but in late 2018, the estimated average cost to produce a bitcoin was ~$4,000, close to where the market ended up bottoming.

For more visit Zima Digital Assets.

#zimadigitalassets #cryptocurrency #bitcoin #zima #digitalassets #crypto #zachsalter #entrepreneur #multidimensionalvisionary